payday loan services near me

Activities affecting IDBI Personal bank loan Rates of interest

IDBI Bank now offers personal loans to have salaried and you can thinking-functioning people around Rs. 5 lakh at glamorous interest levels ranging from 8.15% and you can % p.a beneficial. as floating interest rates and you will between nine.50% and you can % p.a good. while the repaired interest levels. Regarding salaried someone, the maximum ages to avail a personal bank loan was 60 ages and/or chronilogical age of later years (any kind of was before) and you will 75 ages ‘s the restriction age having pensioners. Users can decide a period ranging from 1-five years and you will an operating percentage of just one% + GST out of loan amount is energized.

Other Charges and you will Charge

- Pre-payment or Property foreclosure Costs –

- If the financing are signed just before one year throughout the day out-of disbursal of one’s amount borrowed – 2% of the outstanding loan amount + appropriate fees

- In the event the mortgage try signed following the achievement from one year prior to two years on go out away from disbursal of the amount borrowed – 1% of your own outstanding amount borrowed + relevant taxation.

- Personal loan matter – In accordance with the number of personal loan removed, the interest rate could well be altered not in the reported rate having certain consumers or types of people. A high amount borrowed causes a lowered or even more rates of interest

- Tenure of consumer loan – In line with the discretion of the bank, a lengthier period could have a lower or maybe more speed out of appeal

- Fees skill – IDBI Lender provides a tab with the money and therefore the new cost capability of a consumer. Dependent on amount of money inflows and you will transactions done by a customer, the financial institution might offer specific leniency for the consumer loan interest rates

- Money – Income takes on a significant part for making certain that you’re entitled to obtaining the non-public loan. While doing so, the financial institution will get alter the interest rate to possess a consumer loan according to the money away from a customers

- Possessions – Presence from fixed and you will movable financial assets play a vital financing in the increasing the economic image of one’s lifestyle. In accordance with the exact same, IDBI Lender might provide a good preferential rate of interest private fund

- Connection with the lending company – A current consumer out of IDBI Financial can be sure to get preference when trying to get a personal loan plus the lender might imagine getting a better interest into the buyers. Simultaneously, overdraft form of unsecured loans from IDBI lender have a threshold of 5 times the monthly net salary or retirement on consumer

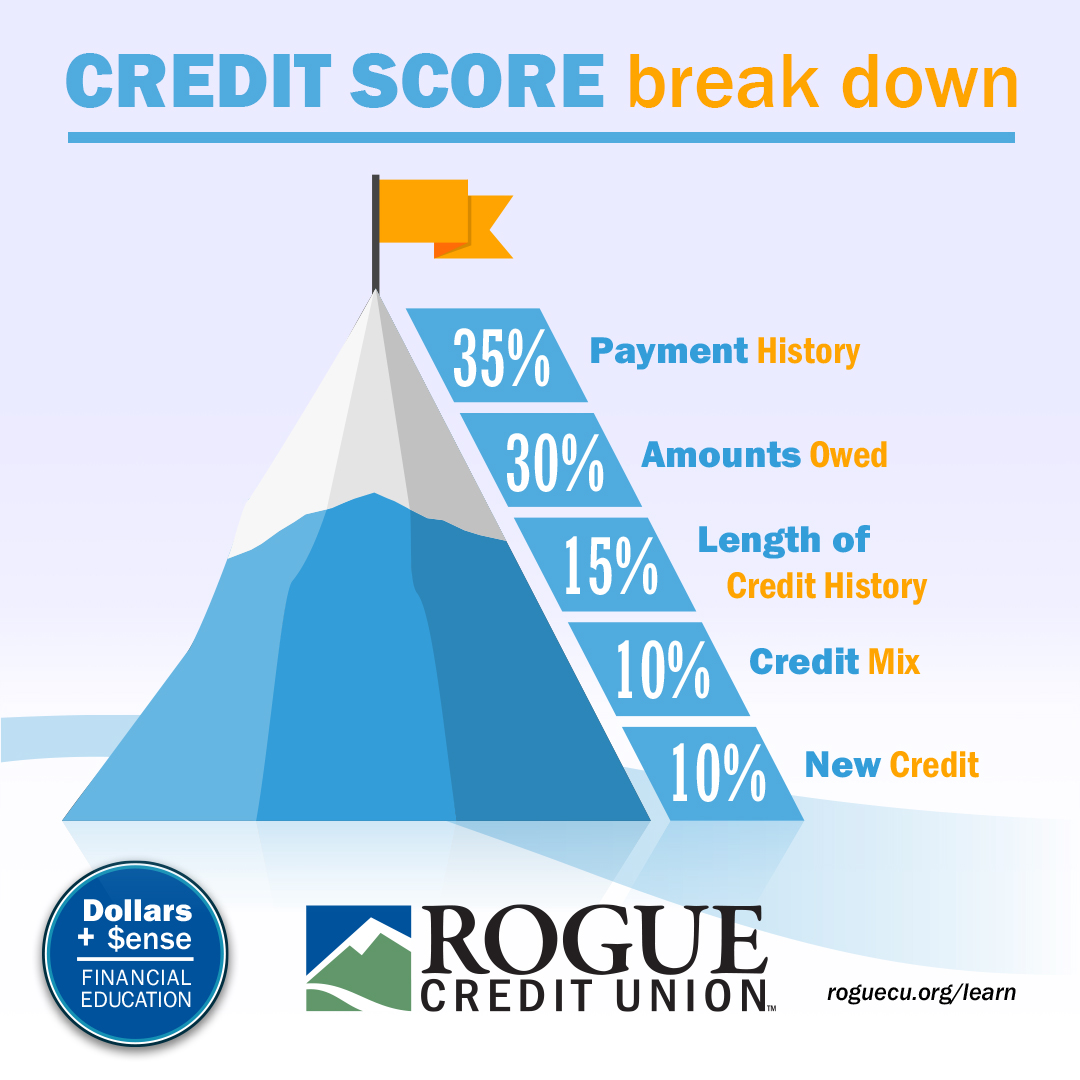

- CIBIL scores – Approval of a consumer loan requires one’s credit score under consideration. Therefore, the fresh CIBIL rating might also work with favour of going a greatest interest regarding the financial

Illustrations

1) Mr. Raj try a citizen out-of Gurugram who really works during the a multiple-national team. He brings a month-to-month paycheck off Rs.fifty,100000. They have taken a personal loan regarding Rs.5 lakh as a result of IDBI Bank. He has availed the mortgage to own a period of five age. The rate of interest relevant into the their loan amount is actually % p.good. Brand new amortisation schedule on the unsecured loan drawn by Mr. Raj will be revealed as follows:

Mr. Raj might be repaying some Rs.10,648 every month with the EMIs of your own individual mortgage. The amount payable by him is actually Rs.6,43,888. The total desire count paid off of the him could be Rs.step 1,38,888.

2. Mrs. Carolina Diniz was a beneficial PSU staff. She brings in a monthly salary away from Rs.twenty five,one hundred thousand. She’s got availed an unsecured loan out-of Rs.1 lakh by way of IDBI Lender. The mortgage could have been availed having a period of five years. The rate of interest billed with the mortgage are % p.a. This new amortisation plan to have Mrs. Coldwater’s consumer loan is provided below:

Mrs. Carolina Diniz would be repaying some Rs.2,129 or Rs.dos,130 four weeks towards the EMIs of consumer loan. The total amount one to she would getting settling try Rs.step one,twenty-eight,778. For example the interest amount that is Rs.27,778.

Faq’s (FAQs)

Sure, you might get a personal loan through IDBI Lender. But not, getting eligible  for the loan you will be required to possess a reputable asset otherwise liability reference to the financial institution.

for the loan you will be required to possess a reputable asset otherwise liability reference to the financial institution.

The minimum income standard to have a good salaried person who wants to avail a consumer loan through IDBI Financial is to try to enjoys an enthusiastic annual net gain away from Rs.step 1.8 lakh.

Minimal income standards to possess a september borrower who would like to get a personal loan compliment of IDBI Bank will be to has actually an annual organization income away from Rs.3.six lakh.

Sure, you might get a top-upwards mortgage past your existing IDBI Bank Unsecured loan. Although not, it’s at the mercy of specific criteria. You must have become holding the mortgage account for the bank for around 12 months and you must have a fees list that is clear.